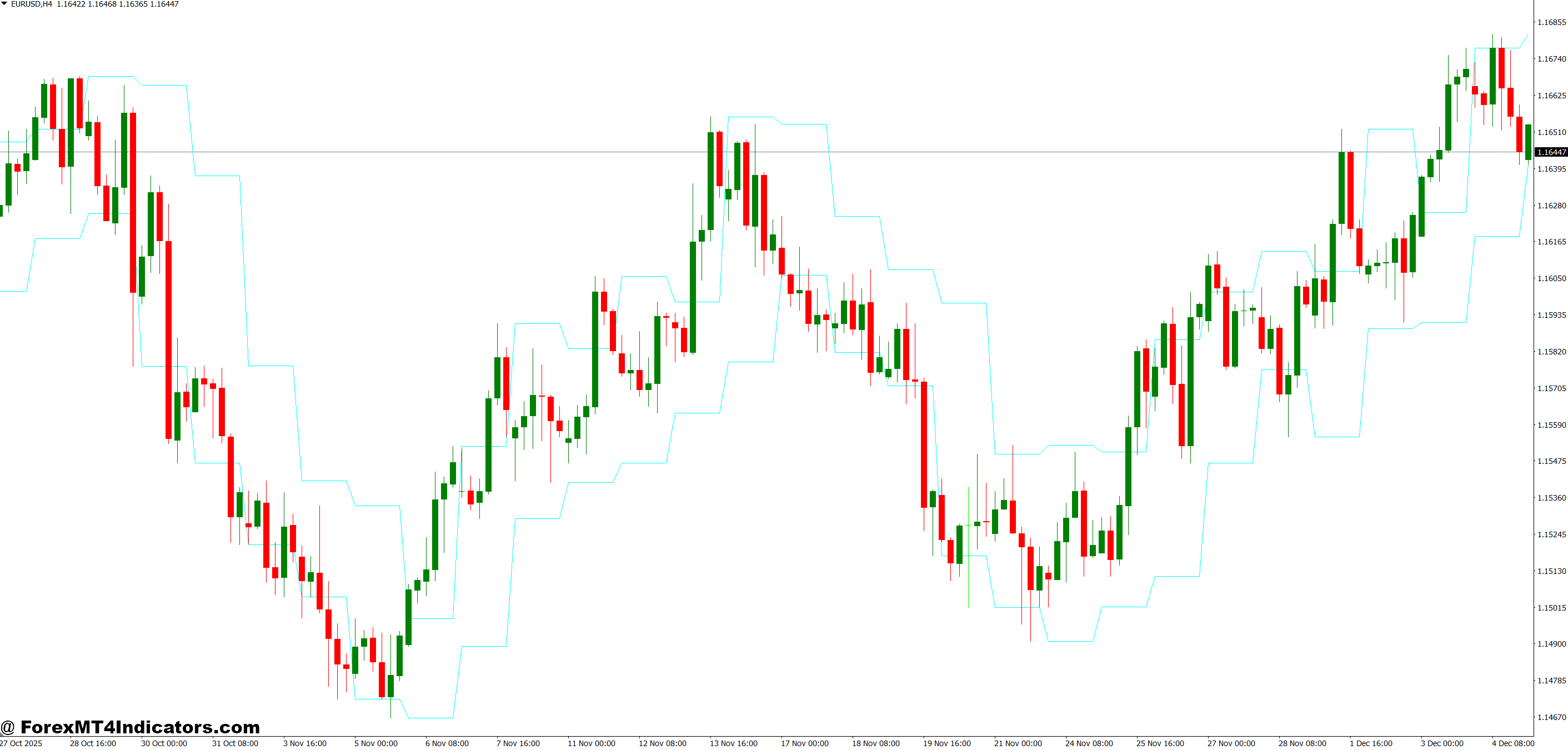

The previous day high low indicator MT4 solves this by automatically plotting yesterday’s price extremes on your chart. No manual calculations. No switching between timeframes to find levels. Just clear horizontal lines showing where price found resistance and support during the prior session. For traders who make decisions based on key levels, this tool removes guesswork from the equation.

What Makes Previous Day Levels Important

Support and resistance aren’t random concepts. They exist because traders remember where price reversed before. Yesterday’s high represents the price level where sellers previously overwhelmed buyers. Yesterday’s low shows where buyers stepped in with enough force to halt the decline.

These levels carry psychological weight. When EUR/USD approaches yesterday’s high at 1.0850, traders who watched that rejection the day before become cautious. New sellers enter, expecting history to repeat. This collective memory creates self-fulfilling prophecies. Price often reacts at these zones not because of magic, but because enough participants make decisions based on them.

The indicator does something simple but valuable. It identifies these two price points from the previous 24-hour period and extends them as horizontal lines into the current session. On a 15-minute or 1-hour chart, you’ll see exactly where yesterday’s boundaries were without scrolling back through data.

How the Calculation Works

The logic behind this indicator is straightforward. At the start of each new trading day (typically 00:00 server time), the indicator scans the previous day’s price action. It finds the highest price reached during that period and the lowest price touched. Those two values become your reference levels.

Here’s what happens in practice. If Monday’s trading saw GBP/USD reach a peak of 1.2750 and a low of 1.2680, those exact prices get plotted as horizontal lines on Tuesday’s chart. The lines extend forward through the current session until a new day begins and fresh levels replace them.

Most versions of this indicator use the D1 (daily) timeframe data as the source. That means it’s pulling the high and low from the full 24-hour session, not from your current chart’s timeframe. This consistency matters because all traders looking at the same pair see identical levels, regardless of whether they’re trading on M5, M15, or H1 charts.

Trading Strategies Using These Levels

Breakout traders watch these lines like hawks. When price consolidates below yesterday’s high and then breaks through with strong momentum, it signals buyer strength. The logic is simple: if price couldn’t get above 1.0850 all day yesterday but smashes through it this morning, something changed. Maybe there’s news, maybe sentiment shifted, but buyers are now in control.

A common approach involves waiting for a clean break above the previous day’s high, then entering long after a brief pullback confirms the breakout. Stop losses typically go just below the breakout level. The previous day’s low becomes a profit target or trailing stop reference point. This creates a defined risk-reward setup.

Range traders use the opposite strategy. If EUR/USD spent yesterday bouncing between 1.0800 and 1.0850, those levels define today’s expected range. Traders sell near the high, buy near the low, and close positions when price reaches the opposite extreme. This works beautifully in low-volatility periods but fails spectacularly when strong trends emerge.

During the London session, I’ve noticed these levels get tested frequently in the first two hours. Price often probes yesterday’s high or low, rejects, then establishes the day’s direction. On GBP/JPY, which moves aggressively during this session, false breakouts happen often. Price spikes through yesterday’s high by 10-15 pips, triggers stops, then reverses. That’s why confirmation matters more than the initial touch.

Settings and Customizations

Most MT4 versions of this indicator let you adjust line colors, thickness, and style. The defaults usually show yesterday’s high as a red dashed line and yesterday’s low as a blue dashed line. Change these to match your chart’s color scheme so they stand out without creating visual clutter.

Some indicators include the previous week’s high and low as well. These weekly levels provide broader context, especially on higher timeframes like H4 or D1. If you trade swing positions held for several days, weekly extremes matter more than daily ones.

The timezone setting deserves attention. Different brokers use different server times. If your broker’s server resets at 00:00 GMT but you’re trading in New York, the “previous day” might not align with your local calendar. This doesn’t make the indicator wrong it just means you need to understand which 24-hour period it’s measuring.

For scalpers on M1 or M5 charts, daily levels might seem too broad. But they still provide context. Knowing you’re approaching yesterday’s low while taking short trades on a 5-minute chart tells you where larger timeframe support exists. You might tighten stops or scale out of positions as price nears these zones.

Strengths and Weaknesses

The biggest advantage is simplicity. You get two objective price levels without interpretation or analysis. There’s no parameter to optimize, no signal to confirm. The high is the high. The low is the low. This objectivity removes discretionary judgment, which helps newer traders avoid analysis paralysis.

These levels also provide universal reference points. Because most traders can see where yesterday’s extremes were, the levels gain significance through collective awareness. When thousands of traders place stops below yesterday’s low, that concentration of orders creates real market impact.

But the indicator has clear limitations. It doesn’t predict price direction. A line on your chart showing yesterday’s high tells you nothing about whether price will break above it or reject from it. You still need additional analysis candlestick patterns, momentum indicators, volume to make trading decisions.

In ranging markets, these levels work great. Price respects boundaries, and the high-low range defines the battleground. But during strong trends, yesterday’s levels become irrelevant fast. If EUR/USD is in a 200-pip trending move, who cares about yesterday’s 50-pip range? The old levels get left behind as price makes new ground.

Whipsaw price action around these levels creates another problem. Price might touch yesterday’s high five times in an hour, each time rejecting slightly. Do you sell every touch? Enter once and hold? The indicator shows the level but doesn’t tell you how to trade it. That’s where your strategy and experience come in.

Comparing to Similar Tools

The pivot point indicator serves a similar purpose but uses different math. Pivot points calculate support and resistance levels based on yesterday’s high, low, and close using specific formulas. You get multiple levels (R1, R2, S1, S2) instead of just two. Traders who want more granular levels often prefer pivots.

Support and resistance indicators attempt to identify these zones automatically by analyzing historical price reactions. They scan for levels where price reversed multiple times and draw zones accordingly. The previous day high low indicator is simpler it doesn’t care about historical reactions, just yesterday’s extremes.

Fibonacci retracement tools also mark potential reversal zones, but they require manual placement based on swing highs and lows. The previous day indicator eliminates that manual work, though it lacks the multiple levels that Fibonacci provides.

What sets this indicator apart is its time-based nature. It refreshes daily with new levels based on the most recent 24-hour period. Other tools might show levels from weeks or months ago. This daily refresh keeps the indicator relevant for short-term traders who care most about recent price action.

How to Trade with Previous Day High Low Indicator MT4

Buy Entry

- Breakout above previous day’s high – Enter long when price closes above yesterday’s high with at least 5-10 pips clearance on EUR/USD 1-hour chart; confirms bullish momentum shift.

- Retest of broken high as support – Buy when price pulls back to yesterday’s high after breaking it, showing 2-3 bullish candles rejecting that level on 15-minute timeframe.

- Bounce from previous day’s low – Go long when price touches yesterday’s low and forms bullish engulfing or hammer candle on GBP/USD 4-hour chart during London session.

- Stop loss below the low – Place stops 10-15 pips beneath yesterday’s low to protect against false breakouts; risk no more than 2% of account per trade.

- Morning range breakout – Enter buy if price consolidates for 2+ hours near yesterday’s high then breaks through with volume spike after 8 AM GMT.

- Avoid during choppy sessions – Skip buy signals during Asian session low-volume periods when EUR/USD typically ranges between previous day’s levels without clear direction.

- Target previous week’s high – Set profit targets at last week’s high level when trading daily charts; provides 3:1 risk-reward ratio on trending pairs.

- Confirm with higher timeframe trend – Only take buy signals when 4-hour and daily charts show uptrend; don’t fight against higher timeframe momentum.

Sell Entry

- Breakdown below previous day’s low – Enter short when price closes below yesterday’s low by 5-10 pips on GBP/USD 1-hour chart with strong bearish candle.

- Rejection at previous day’s high – Sell when price spikes above yesterday’s high but closes back below it within 1-2 candles; indicates failed breakout on 15-minute chart.

- Double top at yesterday’s high – Go short when price tests yesterday’s high twice without breaking through on EUR/USD 4-hour chart; shows resistance holding firm.

- Stop loss above the high – Place stops 10-15 pips above yesterday’s high to limit downside; never risk more than previous day’s range on single trade.

- Fade the breakout – Short false breakouts above yesterday’s high that reverse within 30 minutes on lower timeframes; common trap during news releases.

- Range-bound scalping – Sell near yesterday’s high when price ranges between high/low for 4+ hours without breakout attempt; works best on EUR/USD during quiet sessions.

- Skip before major news – Avoid sell signals 30 minutes before NFP, GDP, or central bank announcements; volatility destroys technical levels.

- Target previous day’s low – Set initial profit target at yesterday’s low level; move stop to breakeven after capturing 50% of the range.

Final Thoughts

Trading forex carries substantial risk. No indicator guarantees profits, and the previous day high low indicator won’t make trading decisions for you. What it does is mark two objective price levels where the market showed clear interest yesterday.

Use these levels as context, not as standalone signals. They work best when combined with trend analysis, momentum confirmation, and proper risk management. The previous day’s high matters more in an uptrend. The previous day’s low gains significance during downtrends.

Start by adding the indicator to your charts and simply observing how price reacts to these levels over a week. You’ll notice patterns certain pairs respect them more than others, certain sessions show more reactions. That observation period builds the experience you need to use these levels effectively. Don’t jump straight into trading them without understanding how they behave with your specific pairs and timeframes.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90