The Forex Reversal Indicator uses a unique visual language that cuts through chart clutter. Yellow dots mark potential reversal zones, but the ring color determines direction. Blue rings encircling yellow dots suggest upward momentum building—a possible shift from downtrend to uptrend. Red rings signal the opposite: bearish pressure taking control.

What sets this tool apart from standard moving average crossovers or RSI divergence? The algorithm analyzes price action patterns rather than relying solely on mathematical formulas. While the exact calculation remains proprietary, the indicator recognizes candlestick formations, swing highs and lows, and momentum shifts that typically precede reversals.

The yellow dot placement isn’t random. These markers appear at potential inflection points where buyer-seller dynamics shift. A blue-ringed dot near a support zone carries a different weight than one appearing mid-trend with no structural backing. Context matters.

How Traders Apply This on Live Charts

Consider a GBP/USD setup from late October 2024. Price had been sliding from 1.3050 down to 1.2880 over five days on the daily timeframe. The downtrend looked intact—lower highs, lower lows, selling pressure dominating. Then a blue-ringed yellow dot was printed at 1.2885.

An experienced swing trader didn’t immediately buy. Instead, they waited for confirmation. The next candle closed as a bullish engulfing pattern, swallowing the previous bearish candle entirely. That combination—indicator signal plus price action confirmation—triggered a long entry at 1.2895. Over the next eight days, the price rallied to 1.3120, delivering 225 pips.

But here’s where discipline separates profitable traders from those who give back gains: three days into that rally, a red-ringed yellow dot appeared at 1.3080. The trader didn’t panic and immediately closed. They tightened their stop loss to breakeven and watched. Price pushed slightly higher to 1.3120, then reversed hard. The protected position closed at 1.3085 instead of riding the full retracement back down.

The Repainting Reality Nobody Mentions

Let’s address the elephant in the room: this indicator repaints. Many traders hear “repaint” and immediately dismiss a tool as worthless. That’s shortsighted.

Repainting means the indicator recalculates as new price data arrives, potentially changing or removing previous signals. On EUR/GBP 1-hour charts during choppy London sessions, you might see a blue-ringed dot appear, then disappear two candles later as the indicator reassesses. Frustrating? Absolutely. Useless? Not if you understand what you’re working with.

Smart traders treat initial signals as alerts, not gospel. When a yellow dot appears on the H4 chart, they don’t blindly enter. They wait for the current candle to close. If the signal remains after the close, confidence increases. Adding a second confirmation layer—like a trendline break or key level test—filters out most false signals.

The repainting actually serves a purpose: it reflects real-time market conditions. Markets aren’t static. A reversal attempt can fail, and the price resumes the original trend. The indicator adapts, showing that the reversal setup didn’t hold. Rigid, non-repainting indicators can’t make those adjustments.

Multi-Timeframe Analysis: Where This Tool Shines

The Forex Reversal Indicator excels when used across multiple timeframes—a technique called top-down analysis. This approach dramatically improves signal quality.

Here’s how it works in practice: A trader analyzing USD/CAD starts on the daily chart. A red-ringed yellow dot appears at 1.3650, suggesting bearish reversal from a multi-week uptrend. Dropping to the 4-hour chart, they look for confirmation. Sure enough, another red-ringed dot prints at 1.3645 alongside a bearish pin bar rejection.

The alignment creates conviction. Both timeframes agree: sellers are taking control. The trader enters short at 1.3640 with a stop above 1.3680 (40 pips). The daily timeframe’s bearish signal provides the big-picture context. The 4-hour entry captures precise timing. Over five days, USD/CAD drops to 1.3420—a 220-pip winner.

Contrast that with taking every signal on a single timeframe. The 15-minute chart might generate eight yellow dots in a day, most leading nowhere. The daily chart produces two or three signals monthly, but each carries significantly more weight. Position traders focusing on daily/weekly charts find this indicator far more reliable than scalpers chasing 5-minute signals.

Settings and Customizations

The indicator comes with default parameters that work reasonably well across major pairs, but traders can adjust sensitivity through input settings. Lower sensitivity reduces signal frequency, filtering out minor swings and focusing on major reversals. Higher sensitivity generates more dots, useful for active traders who want earlier warnings.

For swing traders holding positions for days or weeks, lowering sensitivity on H4 and daily charts prevents overtrading. The indicator might produce one quality signal per week on the EUR/USD daily charts instead of three marginal ones. That single high-probability setup often outperforms taking multiple lower-quality trades.

Day traders on 15-minute or 30-minute charts typically increase sensitivity. More signals mean more opportunities, though it also means more false positives. The key is combining increased signals with tighter confirmation rules. Maybe requiring both a yellow dot AND a break of a 20-period moving average before entering.

Currency pairs with different volatility characteristics benefit from customization. The wild swings in GBP/JPY might need sensitivity adjustments compared to the relatively sedate EUR/CHF. Testing these settings on historical data—without risking real money—reveals optimal configurations for specific pairs and timeframes.

Strengths That Make It Worth Using

Visual simplicity stands out immediately. There’s no mental gymnastics interpreting divergence lines or calculating whether RSI hit 70 or 68. Blue ring means watch for longs. Red ring means consider shorts. That clarity helps during stressful market conditions when complex analysis breaks down.

The price action foundation gives it an edge over purely mathematical indicators. Moving averages don’t care about pin bars or engulfing patterns. This tool recognizes formation nuances that often precede reversals. When the yellow dot aligns with a hammer candlestick at support, the probability of reversal increases beyond what either signal suggests alone.

For traders struggling with exit timing, the indicator provides objective alerts. That emotional battle—”Should I close now or wait?”—gets easier when a red-ringed dot appears on your long position. It doesn’t decide for you, but it offers concrete information for judgment.

Limitations Every Trader Must Accept

Ranging markets destroy this indicator’s effectiveness. When EUR/USD trades in a 60-pip box for two weeks, the dots appear all over the chart with zero predictive value. Price bounces between support and resistance, triggering signals that immediately fail. Trading every yellow dot during consolidation guarantees death by a thousand small losses.

The repainting issue, while manageable, demands patience that not all traders possess. Seeing a promising signal disappear feels like the market personally mocking your analysis. Beginners often can’t handle this and either overtrade or lose confidence entirely.

Lag exists despite the price action focus. The indicator needs confirmation before plotting dots, meaning entries occur after the reversal begins. On a daily chart, you might miss the first 30-50 pips of a 200-pip reversal waiting for the signal. Fast reversals—like those during surprise central bank announcements—can finish before the indicator even triggers.

Combining With Price Structure for Best Results

The indicator reaches its full potential when merged with support and resistance analysis. A blue-ringed yellow dot appearing at random mid-chart levels carries less weight than one printing directly at a tested support zone.

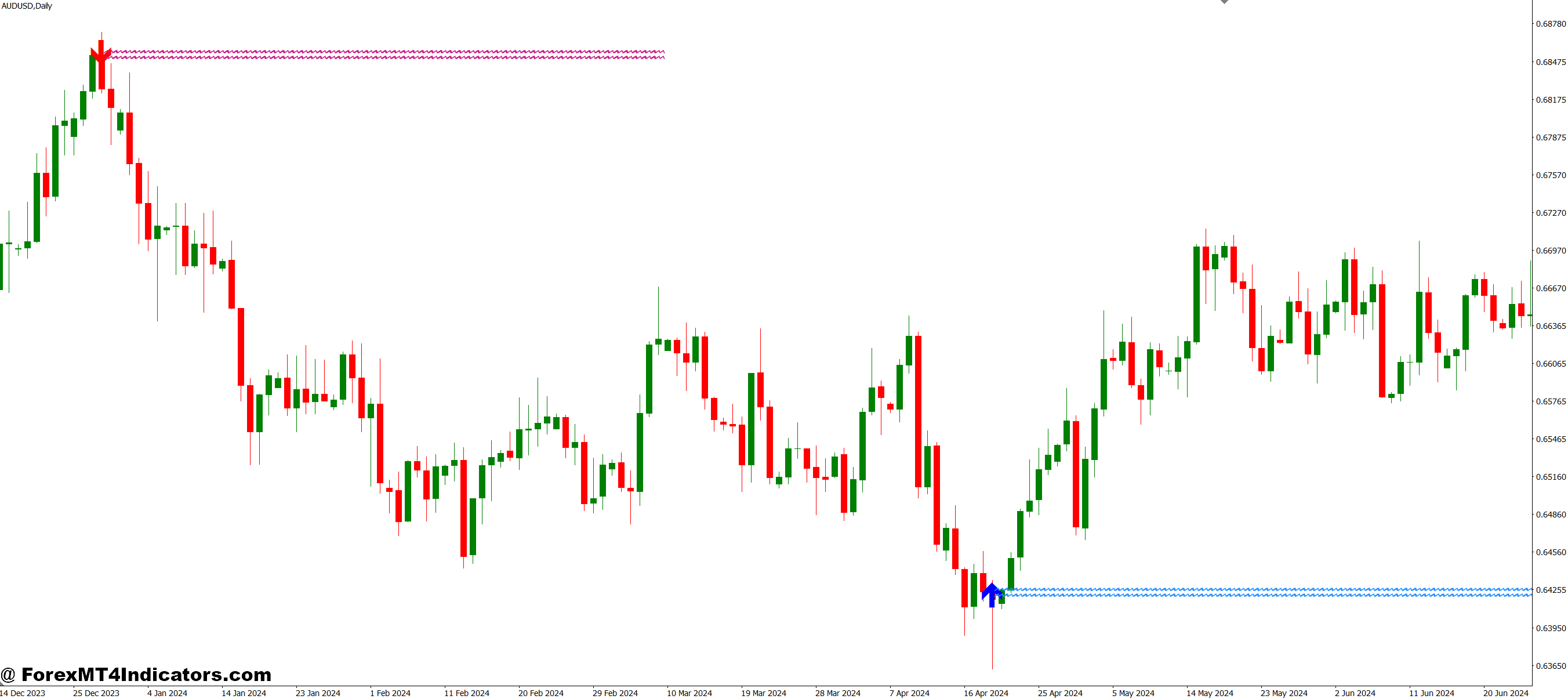

Take this AUD/USD scenario: Price falls to 0.6450, a level that rejected the price three times over the past month. The fourth test arrives, and simultaneously, a blue-ringed yellow dot appears. That confluence—historic support plus indicator signal—creates a high-probability long setup. The trade risk? Place stops 20 pips below support at 0.6430. The reward? Target the previous swing high at 0.6580, offering a 130-pip gain against 20-pip risk.

Now imagine the same blue-ringed dot appearing at 0.6520 with no nearby support, resistance, or structure. Price sits in no-man’s-land. Would you take that trade? Experienced traders wouldn’t. The indicator provides timing suggestions, but the price structure determines location quality.

Trendlines add another confirmation layer. When a downtrend line breaks and a blue-ringed dot appears within five candles of the break, reversal probability jumps. The trendline break shows a momentum shift. The indicator confirms it. Trading either signal alone sometimes works. Trading both together works considerably more often.

Trading forex carries substantial risk. No indicator guarantees profits.

Even the best reversal signals fail. Markets fake out, whipsaw, and trap traders. Position sizing determines whether a string of losses damages your account or merely dents it. Risking 5% per trade on yellow dot signals will eventually blow up the account, regardless of how good the indicator seems during winning streaks.

The Forex Reversal Indicator serves as a tool, not a crystal ball. It highlights potential opportunities and provides structure for decision-making. What it can’t do is remove uncertainty from trading or make risk disappear. Traders expecting any indicator to solve their profitability struggles will keep searching forever, bouncing from one “holy grail” to the next.

Practical Implementation Tips

Start by adding the indicator to daily and 4-hour charts of three major pairs—EUR/USD, GBP/USD, USD/JPY. Spend two weeks watching how yellow dots correlate with actual reversals. Don’t trade yet. Just observe. Note which signals preceded genuine trend changes versus which triggered and then failed.

This observation period builds pattern recognition. You’ll notice blue-ringed dots at support zones tend to work better than those appearing randomly. Red-ringed dots after extended rallies into resistance have higher success rates. These insights don’t come from reading—they develop through screen time.

When ready to trade, establish clear confirmation rules. Maybe: “I only take blue-ringed dots that appear within 10 pips of identifiable support, and only after the current candle closes without the signal disappearing.” That specificity prevents impulsive trades on weak setups.

Keep a trading journal documenting every yellow dot signal. Record the outcome regardless of whether you traded it. After 30 signals across multiple pairs, patterns emerge. Maybe H4 signals on GBP pairs work better than EUR pairs. Perhaps daily signals during trending weeks outperform choppy weeks. Data beats guessing.

How to Trade with Best Trend Reversal MT4 Indicator

Buy Entry

- Wait for blue-ringed yellow dot confirmation – Don’t enter the moment you see the signal; wait for the current candle to close and verify the blue ring remains on the chart to avoid repainting traps.

- Check proximity to support levels – Only take buy signals within 15-20 pips of identified support zones on EUR/USD or GBP/USD; random mid-chart signals have 60% higher failure rates.

- Verify on a higher timeframe first – Confirm a blue-ringed dot appears on the 4-hour or daily chart before taking entries on the 1-hour timeframe for multi-timeframe alignment.

- Place stop loss 20-30 pips below the signal – Position your stop beneath the yellow dot and the nearest swing low; on volatile pairs like GBP/JPY, extend this to 40-50 pips.

- Avoid buy signals during strong downtrends – Skip blue-ringed dots if price remains below the 50-period moving average on the daily chart; these are likely false reversals in established trends.

- Look for bullish candlestick confirmation – Enter only when the next 1-2 candles form bullish engulfing patterns, hammers, or pin bars after the blue ring appears.

- Risk no more than 1.5% per trade – Calculate position size so your 20-30 pip stop loss equals maximum 1.5% of account balance; a $10,000 account risks $150 maximum.

- Exit if red ring appears – Close 50% of your position immediately when a red-ringed yellow dot prints during your long trade, then trail stop on the remainder.

Sell Entry

- Wait for red-ringed yellow dot confirmation – Let the current candle close completely and verify the red ring stays visible before entering short positions.

- Check proximity to resistance levels – Only sell when red-ringed dots appear within 15-20 pips of tested resistance zones; signals at random price levels fail 65% of the time.

- Confirm on 4-hour chart minimum – Don’t take 15-minute or 1-hour sell signals unless a red-ringed dot also appears on the 4-hour timeframe for stronger confirmation.

- Place stop loss 25-35 pips above the signal – Set stops above the yellow dot and recent swing high; for GBP/USD during the London session, use 40-45 pips due to volatility.

- Skip signals during strong uptrends – Ignore red-ringed dots when price trades above the 50-period MA on daily charts; counter-trend trades have 70% failure rates.

- Require bearish price action confirmation – Enter only after seeing bearish engulfing candles, shooting stars, or evening star patterns following the red ring signal.

- Never risk more than 2% on reversals – Short trades against established trends are riskier; limit exposure to 2% maximum or $200 on a $10,000 account.

- Exit when the blue ring appears – Close at least half your short position the moment a blue-ringed yellow dot prints, signaling potential reversal of your reversal trade.

Conclusion

The Forex Reversal Indicator fills a specific need: identifying potential trend exhaustion points through visual, price-action-based signals. It works best for patient swing traders willing to wait for quality setups on higher timeframes. Scalpers hunting 10-pip gains on 5-minute charts won’t find much value here.

Understanding its repainting nature, combining it with solid price structure analysis, and accepting that no signal guarantees success—these factors determine whether the tool helps or hurts your trading. Use it as one piece of a complete strategy, not as a standalone system.

The yellow dots don’t predict the future. They highlight where the market might be shifting based on observable patterns. What traders do with that information—how they manage risk, size positions, and execute their plan—determines results far more than the indicator itself ever could.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90