BlackRock expect hikes this week from the Fed, ECB and BoE and then more to come:

Getting inflation Read this Term We expect central banks to keep rates high as recession unfolds – not save the day as in the past. Yet Treasury yields have slid as the market expects Federal Reserve Read this Term

More:

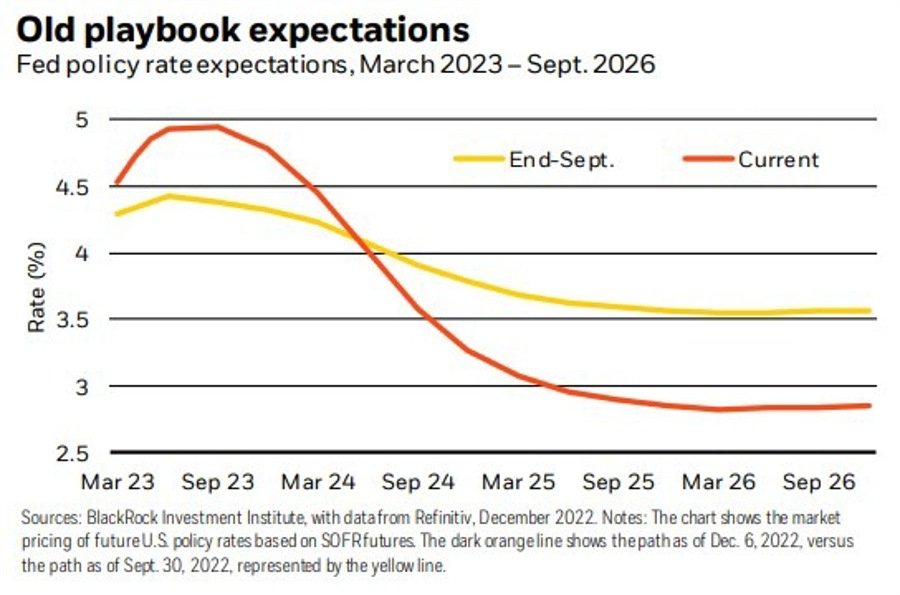

We think markets are pricing in rate cuts starting in mid-2023 (the dark orange line in the chart) because they think the Federal Reserve will ride to the rescue when recession hits – the old playbook. That view has made U.S. yield curves the most inverted since the Fed’s last rapid hiking cycle in the 1980s, with five-year Treasury yields falling more than two- and 10-year yields over the past month. That’s boosted stocks. We see core inflation falling further next year from current levels but think central banks won’t be getting it back to 2% targets. Doing so would require an even deeper recession, in our view, and we see them stopping short of such an outcome as the damage from policy overtightening becomes clearer. So we see central banks living with persistently above-target inflation – and they won’t be able to cut rates as quickly as markets expect, in our view

—

I don’t see the Reserve Bank of New Zealand mentioned in the Black Rock report outlining their views, but hiking into a recession is exactly what the RBNZ is doing right now.

ADVERTISEMENT – CONTINUE READING BELOW