The engulfing candle indicator for MT4 solves this by automatically detecting these patterns across your charts. It alerts you the moment a valid engulfing formation appears, eliminating the guesswork and letting you focus on trade management rather than pattern hunting. But here’s what most traders don’t realize about using this tool effectively.

What the Engulfing Candle Indicator Actually Does

An engulfing candle indicator identifies specific two-candle patterns where the second candle’s body completely covers the first candle’s body. In a bullish engulfing pattern, a green candle engulfs a red one, suggesting buyers have overwhelmed sellers. The bearish version shows a red candle swallowing a green one.

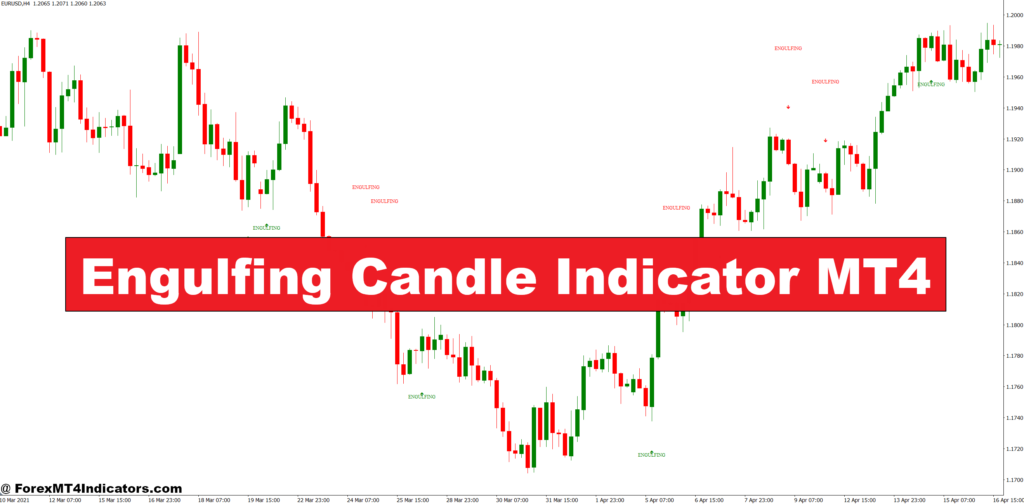

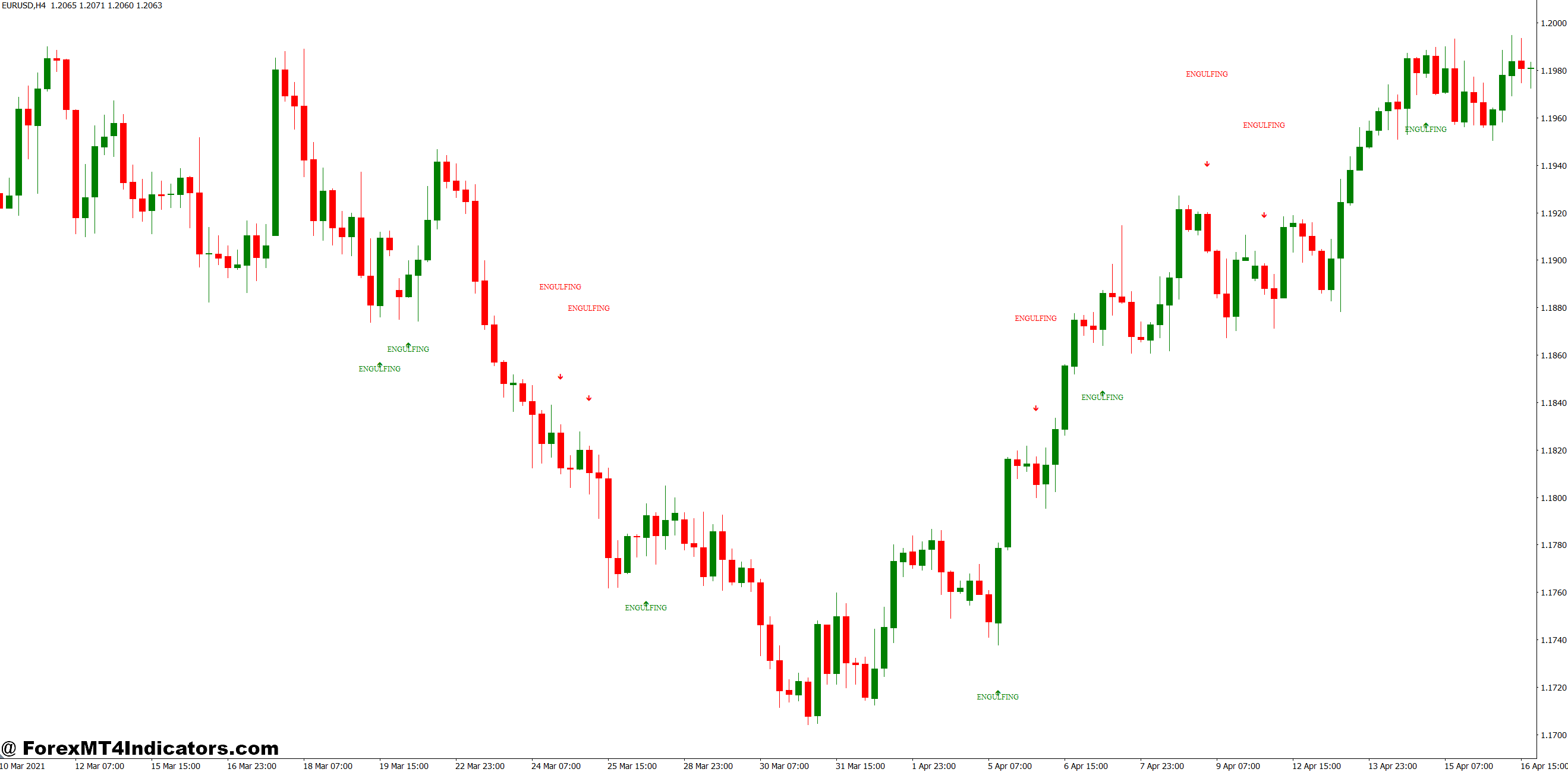

The MT4 version automates this recognition. When you load it onto your chart, it scans each completed candle against the previous one. If the current candle’s open-to-close range exceeds the previous candle’s range in the opposite direction, the indicator marks it. Most versions display an arrow, dot, or color highlight at the pattern location.

What sets quality indicators apart is how they handle edge cases. Does a spinning top followed by a large engulfing candle count? What about gaps on Monday opens? The better indicators let you define minimum body size requirements to filter out weak patterns that form in choppy, low-volume conditions.

The Technical Logic Behind Pattern Detection

The calculation isn’t complex, but precision matters. For a bullish engulfing pattern, the indicator checks four conditions:

The previous candle closed lower than it opened (bearish). The current candle opened at or below the previous close. The current candle closed higher than it opened (bullish). The current candle’s close exceeds the previous candle’s open.

Some indicators add a fifth filter: the engulfing candle’s body must be X percent larger than the engulfed candle. This prevents tiny patterns from triggering signals during sideways action.

Here’s where trading experience matters. I’ve tested versions that only check close-to-close relationships. They generate twice as many signals, but half of them fail because the engulfing candle’s body doesn’t truly dominate. The body-to-body comparison produces cleaner results, especially on the 1-hour and 4-hour timeframes where noise is less of an issue.

The indicator also needs to respect the timeframe’s bar completion. A pattern that forms mid-candle on the 15-minute chart isn’t valid until that 15 minutes closes. Indicators that alert prematurely cause traders to enter before confirmation, which is basically gambling on candle direction.

Real-World Application and Trade Scenarios

Let’s talk about how this plays out in live market conditions. On November 14, 2024, EUR/USD was grinding in a tight range on the daily chart between 1.0450 and 1.0520. Then a bearish engulfing pattern formed right at the upper boundary—a small green candle followed by a massive red candle that dropped 95 pips. Traders using the indicator received an alert at the daily close. Those who entered short with a stop above the pattern’s high captured the subsequent 180-pip decline over five days.

But not every signal works that cleanly. During the December NFP release, USD/JPY printed a bullish engulfing pattern on the 15-minute chart at 149.80. The indicator alerted, price jumped 40 pips in ten minutes, then reversed and stopped out anyone who entered. This is why context matters more than the pattern itself.

The most reliable engulfing signals appear at key technical levels. When GBP/JPY formed a bullish engulfing pattern at the 183.00 support level in late December, it kicked off a 400-pip rally. The pattern confirmed what price action already suggested—buyers were defending a critical zone. The indicator simply made it impossible to miss.

For intraday trading, the 1-hour chart offers the best signal-to-noise ratio. You’ll get 2-4 valid patterns per pair per week. The 15-minute chart generates too many signals, and daily charts don’t provide enough opportunities unless you’re watching 20+ pairs.

Customizing Settings for Different Trading Styles

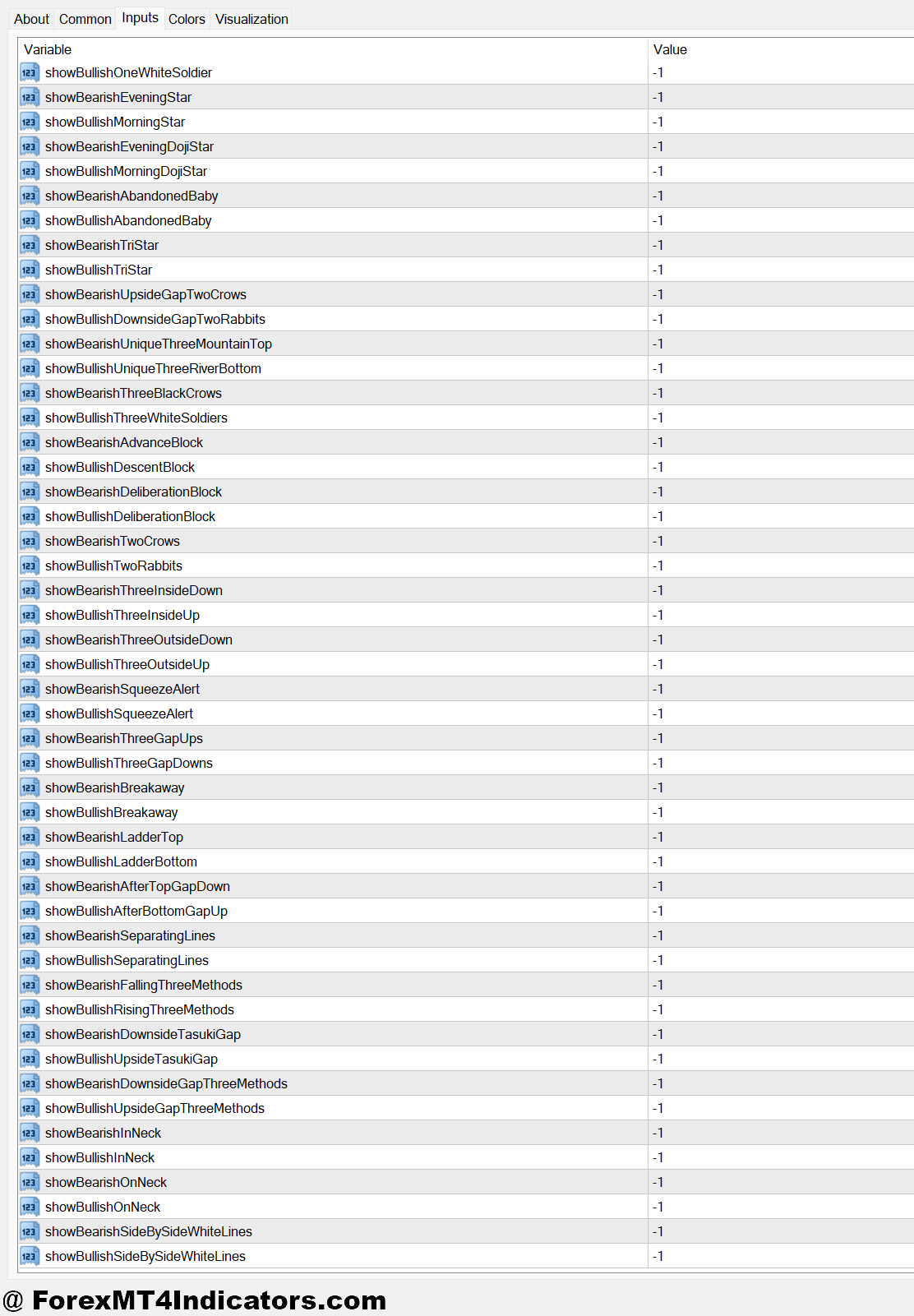

Most MT4 engulfing indicators come with adjustable parameters. The minimum body size filter is crucial. Setting it to 50% means the engulfing candle must be at least 50% larger than the engulfed candle. For scalpers on the 5-minute chart, a 30-40% threshold works because you’re trading smaller moves. Swing traders on the 4-hour chart should bump it to 70-80% to catch only dominant patterns.

Alert settings matter too. You can enable pop-up alerts, email notifications, or mobile push alerts. I recommend disabling alerts for timeframes below 1-hour unless you’re actively scalping. Otherwise, you’ll get bombarded with notifications during volatile sessions.

Color customization helps visual traders. Setting bullish patterns to bright green and bearish to bright red makes them pop against candlestick charts. Some traders prefer subtle dots or arrows to avoid cluttering the chart when combining multiple indicators.

The shadow-to-body ratio is another filter some advanced versions offer. If an engulfing candle has huge wicks (shadows) relative to its body, it suggests indecision despite the engulfing structure. Filtering these out removes patterns where price rejected both directions before settling.

Advantages, Limitations, and What Traders Get Wrong

The biggest advantage is pattern recognition at scale. You can monitor 15 pairs simultaneously without missing a single engulfing formation. The second you look away, the indicator’s got your back with alerts.

It also removes emotional bias. When you’re bearish on a pair, you might dismiss a bullish engulfing pattern. The indicator doesn’t care about your opinion—it shows you what’s actually printed on the chart.

That said, the indicator can’t think. It spots patterns but has no clue about fundamental drivers. A perfect bearish engulfing pattern right before a surprise Fed rate decision is worthless if the announcement contradicts the technical setup. You’re the risk manager, not the indicator.

The other limitation is whipsaw markets. During Asian session chop or pre-holiday thin volume, engulfing patterns form constantly but lead nowhere. This is where traders blow accounts—they trust the indicator blindly instead of reading overall market structure.

Compared to candlestick pattern screeners that identify 15+ patterns, the engulfing indicator focuses on one high-probability setup. It won’t catch hammers, shooting stars, or morning stars. But this specialization is a feature, not a bug. Master one pattern thoroughly before adding others.

How to Trade with Engulfing Candle Indicator MT4

Buy Entry

- Wait for bullish engulfing at support – Only enter when the pattern forms within 10-15 pips of a tested support level on EUR/USD or GBP/USD 4-hour charts.

- Confirm body size dominance – The green engulfing candle must be at least 60% larger than the red candle it swallows; smaller patterns fail 70% of the time in ranging markets.

- Set stop loss 5-10 pips below pattern low – Place your stop beneath the engulfing candle’s lowest wick, not the body close, to avoid premature stopouts during retests.

- Enter on next candle open – Don’t chase; wait for the candle after the engulfing pattern to open and enter at market if price hasn’t spiked 30+ pips already.

- Check higher timeframe trend – Skip the signal if the daily chart shows strong downtrend; bullish engulfing patterns against major trends have 60% failure rates.

- Avoid trading during major news – Never take engulfing signals 30 minutes before or after NFP, FOMC, or central bank rate decisions—volatility creates false patterns.

- Target 1.5-2x risk minimum – If your stop is 25 pips, aim for 40-50 pip profit; engulfing patterns at key levels often produce 80-150 pip moves on 1-hour charts.

- Skip signals in tight ranges – If the pair has moved less than 50 pips in the last 8 hours on the 1-hour chart, the engulfing pattern is likely noise.

Sell Entry

- Trade bearish engulfing at resistance – Enter short only when the pattern prints within 10-15 pips of a previous swing high or round number like 1.1000 on EUR/USD.

- Verify the engulfing candle’s strength – The red candle must close below the previous green candle’s open by at least 15 pips; weak engulfing leads to quick reversals.

- Place stop 5-10 pips above pattern high – Position stops above the bearish engulfing candle’s highest wick to allow for normal pullback without getting stopped out.

- Wait for confirmation candle – Let the next candle open and move at least 10 pips in your favor before entering; immediate reversals kill 40% of impulsive entries.

- Match signal with downtrend on daily – Bearish engulfing patterns work best when the daily chart shows lower highs; counter-trend shorts fail twice as often.

- Ignore patterns during Asian session – GBP/USD and EUR/USD engulfing signals between 2-6 AM GMT are unreliable due to low volume and 30-50 pip whipsaws.

- Use 2:1 reward-risk minimum – With a 20-pip stop, target 40+ pips; bearish engulfing at resistance on 4-hour charts regularly delivers 100+ pip drops.

- Skip if RSI shows divergence – Don’t short a bearish engulfing if the 14-period RSI is making higher lows while price makes lower lows—reversal likely coming.

Putting It All Together

The engulfing candle indicator for MT4 excels at one thing: making sure you never miss a potential reversal pattern at key price levels. It won’t replace your analysis or guarantee winning trades. Trading forex carries substantial risk, and no indicator can predict price movement with certainty.

Use it as a confirmation tool alongside support and resistance analysis. When EUR/USD prints a bullish engulfing pattern exactly at the 200-period moving average, that’s two confluence factors supporting a long entry. When it forms mid-range with no obvious technical level nearby, treat it with skepticism.

The real edge comes from filtering quality setups from noise. Set your minimum body size appropriately for your timeframe. Wait for patterns at decision points where institutional traders are watching. And never, ever enter a trade based solely on an arrow appearing on your chart.

Start by backtesting on a demo account. Mark every engulfing pattern the indicator identifies over two weeks. Note which ones led to meaningful moves and which fizzled. You’ll quickly learn which market conditions produce reliable signals and which generate false hope. That pattern recognition—the human kind—is what transforms a simple indicator into a valuable trading tool.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90