The Bank of England delivered its fifth consecutive rate cut since last summer, reducing Bank Rate by 0.25 percentage points to 4% following its August meeting.

However, the decision revealed a deeply divided Monetary Policy Committee, with the vote split 5-4 – marking one of the closest decisions in recent memory as policymakers wrestle with competing inflation and growth pressures.

Key Takeaways from the BOE Decision

- Narrow victory for doves: Five members voted to cut rates by 25bp, while four preferred to hold at 4.25%. One member (Alan Taylor) initially wanted a more aggressive 50bp cut but voted for 25bp rather than no cut.

- Inflation expected to peak at 4%: The MPC projects CPI inflation will rise to 4.0% in September before gradually falling back toward the 2% target, driven largely by food price pressures and temporary factors.

- Labour market showing slack: Unemployment has risen to 4.7% with continued weakening in employment growth, creating spare capacity that should help contain inflationary pressures.

- Services inflation remains stubborn: Despite wage growth moderating to around 5%, services price inflation has stayed elevated at 4.7%, raising concerns about persistent domestic price pressures.

- Gradual approach maintained: The Committee emphasized that future rate cuts will be data-dependent, with “no pre-set path” for monetary policy as they balance competing inflation and growth risks.

Link to official BOE Monetary Policy Statement (August 2025)

The August decision highlighted fundamental disagreements within the MPC about the inflation outlook. The four members who voted to hold rates – Megan Greene, Clare Lombardelli, Catherine Mann, and Huw Pill – cited concerns that “the disinflationary process had slowed and the risk of inflation expectations feeding through to second-round effects had risen.”

These hawks pointed to elevated business and household inflation expectations, with inflation projected to peak at 4% and much of the recent upside driven by highly salient food and energy prices. They worried about structural changes in goods and labour markets that could make inflation more persistent.

Link to BOE MPC meeting minutes and Monetary Policy Report

Conversely, the five members supporting the cut saw sufficient progress in underlying disinflation, particularly in labour market quantities and wages. However, even within this group, there were notable differences, with Alan Taylor initially preferring a 50bp cut, arguing that domestic inflation was “tightly linked to wages” and that the labour market had slack that was “deteriorating further.”

A significant focus of the August meeting was the outlook for food price inflation, which the BOE expects to rise to around 5.5% by year-end. This surge reflects multiple factors: higher global agricultural commodity prices, elevated UK labour costs (particularly from National Living Wage increases), and new Extended Producer Responsibility regulations for packaging coming into effect in October.

The MPC expressed particular concern about food prices’ potential impact on household inflation expectations, noting that households pay disproportionate attention to food costs when forming views about future inflation. Historical analysis suggests that food price changes have become even more influential on expectations since 2022’s inflation surge.

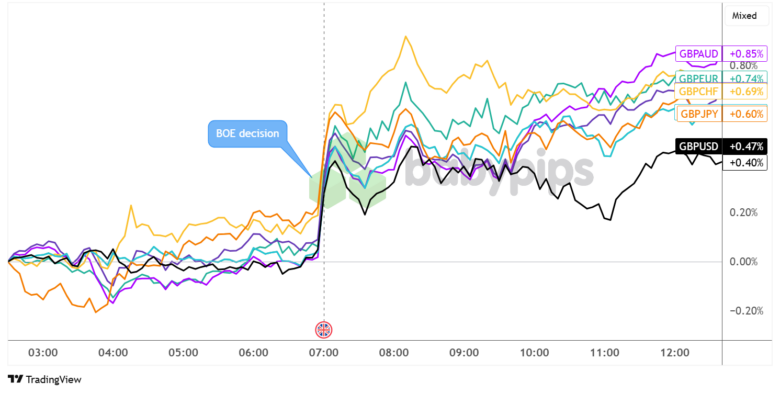

Market Reactions

British Pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart by TradingView

Sterling jumped higher after seeing the MPC vote breakdown, as markets had been expecting a near-unanimous decision to cut interest rates. The U.K. currency staged a broad rally immediately after the release, dipping slightly an hour after the decision but holding on to most of its gains for the rest of the session.

The GBP/AUD pair performed strongest, gaining +0.85%, while GBP/EUR advanced +0.74% and GBP/CHF rose +0.69%. The pound also strengthened against the yen, with GBP/JPY up +0.60%. However, against the US dollar, gains were more modest at +0.47%, suggesting relative dollar strength persisted despite the BOE’s easing.