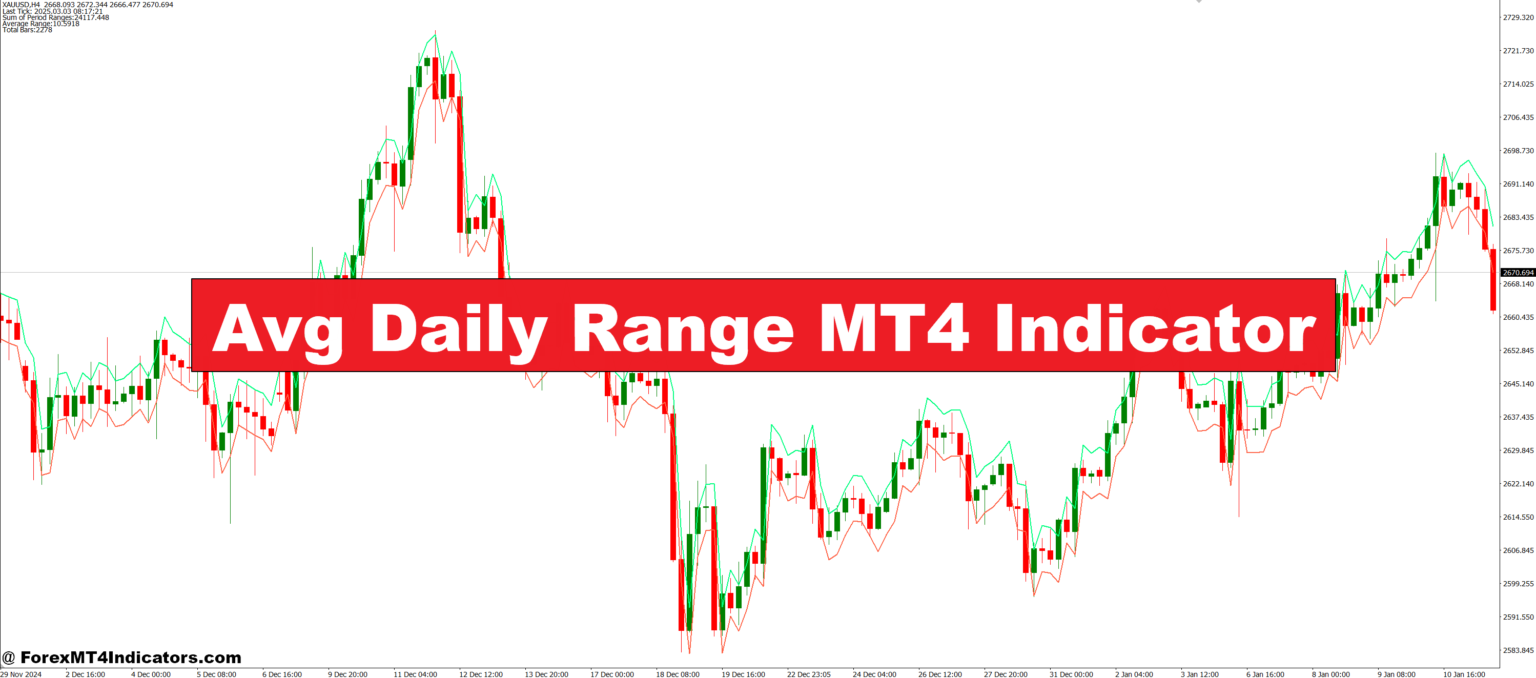

The Avg Daily Range (ADR) MT4 Indicator is a helpful tool designed for MetaTrader 4. It calculates the average distance that a currency pair moves each day, usually based on the last 5, 10, or 20 days. This value tells traders what kind of movement they can expect on a typical day. The indicator usually shows this as a number in pips and sometimes displays high and low levels based on the ADR. It’s especially useful for day traders and scalpers who rely on short-term price movements.

Why It Matters in Forex Trading

Knowing the average daily range gives traders an edge. Without it, they might aim for profits that are too big or too small compared to what the market can realistically offer. For example, if a pair typically moves 80 pips a day, aiming for 150 pips might be unrealistic. The ADR helps set more accurate take-profit and stop-loss levels, keeping trades within logical boundaries. It also keeps traders aware of whether the market is calm or highly volatile, which can guide entry and exit decisions.

How to Use the ADR Indicator in Trading

To use the ADR indicator, traders simply add it to their MT4 chart. Once applied, it shows the average daily pip range and sometimes displays today’s range in real time. If the price has already moved close to the full ADR, it may not be the best time to enter a trade—there might be limited room left for profit. On the other hand, if the market is still early in its range, traders can look for setups with confidence. Some also combine ADR with other tools like support and resistance or candlestick patterns for better accuracy.

How to Trade with Avg Daily Range MT4 Indicator

Buy Entry

- Check if the current day’s price has moved less than 50–70% of the ADR value (room left to move upward).

- Price is near a support level or key zone (use horizontal lines or pivot points).

- Look for bullish confirmation signals (e.g., bullish candlestick patterns like pin bars or engulfing).

- Enter the buy trade with a target that stays within the ADR limit (e.g., if ADR is 100 pips, don’t target more than 80–90 pips).

- Set stop-loss just below the recent swing low or below the support zone.

Sell Entry

- Check if the current day’s price has moved less than 50–70% of the ADR value (room left to move downward).

- Price is near a resistance level or key ceiling (previous highs or strong barriers).

- Look for bearish confirmation signals (e.g., bearish engulfing or shooting star).

- Enter the sell trade with a target that stays within the ADR range.

- Set stop-loss just above the recent swing high or above the resistance area.

Conclusion

The Avg Daily Range MT4 Indicator is a powerful yet simple tool that helps traders understand daily price movement. By giving insight into typical volatility, it allows smarter decision-making and better risk control. Whether you’re new to forex or an experienced trader, using the ADR can help you avoid common mistakes and improve your overall strategy. Give it a try and let the numbers guide your next trade.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐