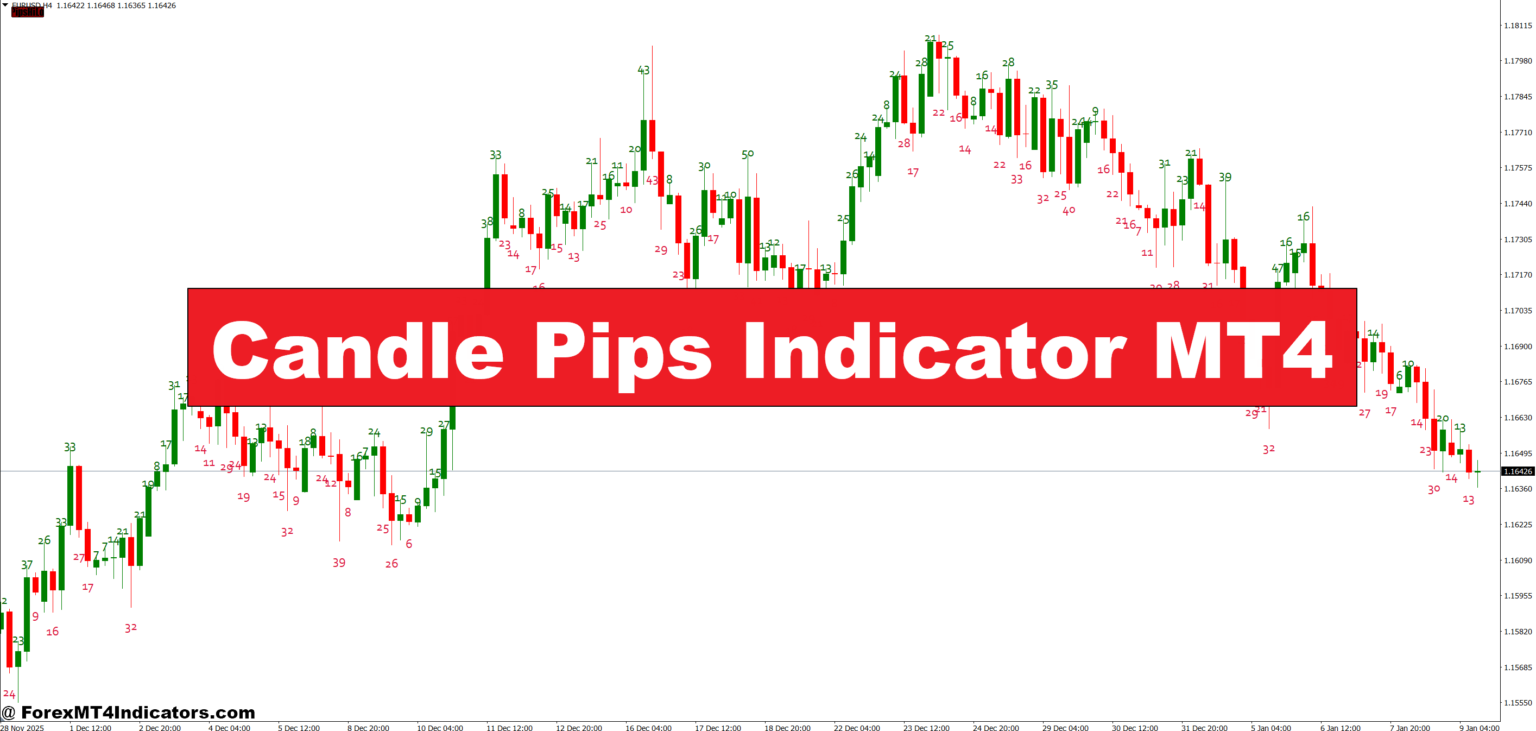

What separates this from eyeballing charts is precision. A candle might look large on a compressed daily chart but only represent 20 pips, while a tiny-looking candle on a 1-minute chart during London open could span 15 pips significant for scalpers. The indicator eliminates guesswork by labeling each candle with its measurements, typically displayed near the candle high or as an overlay.

Most versions allow customization of what data appears. Some traders only want body size shown, while others prefer full breakdowns including wick ratios. The calculations use the standard pip definition: for pairs like EUR/USD, one pip equals 0.0001, while for JPY pairs, it’s 0.01.

How Traders Apply It in Real Setups

Here’s where theory meets practice. Swing traders on the daily chart use body size to filter momentum. If EUR/GBP prints three consecutive 40-pip bodies in one direction, that signals stronger conviction than six 15-pip candles covering the same distance. The difference? In the first scenario, sellers (or buyers) controlled price consistently without major pushback.

Scalpers take a different approach. On the 5-minute GBP/USD chart during New York session, they watch for candles with small bodies (5-8 pips) but large wicks (20+ pips). This pattern often signals indecision or absorption large orders soaking up momentum. Smart scalpers fade these moves, entering counter-trend when the next candle confirms rejection.

One specific example: GBP/JPY on the 15-minute chart forms a bullish candle with a 35-pip body and only 5-pip wicks on both ends. That’s a high conviction move buyers stepped in decisively. A trader might enter on a pullback to that candle’s close, placing stops below the low. Compare this to a candle with a 20-pip body but 30-pip lower wick. The latter shows bulls faced serious resistance, making continuation less reliable.

Range traders flip the script. When USD/CAD on the 1-hour chart shows average candle ranges dropping from 25 pips to 10 pips, the market’s entering consolidation. These traders wait for expansion when candle ranges suddenly spike back to 30+ pips, a breakout’s likely brewing.

Customization and Settings That Matter

The indicator typically includes several adjustable parameters. Pip display location comes first users can position measurements above candles, below them, or at a fixed corner of the chart. This prevents clutter on multi-indicator setups.

Color coding is another key setting. Some versions let traders set thresholds: candles with bodies above 30 pips might display in green, while those below 10 pips show in gray. This instant visual feedback helps pattern recognition. During a GBP/USD trend, seeing a string of green labels (large bodies) followed by gray ones (small bodies) suggests momentum’s fading.

Timeframe filtering matters for multi-chart traders. The indicator can be set to only display data on specific timeframes daily and 4-hour for position traders, or 1-minute and 5-minute for day traders. Running it on all timeframes simultaneously creates information overload.

A less obvious adjustment: wick-to-body ratio alerts. Some advanced versions highlight candles where wicks exceed body size by a certain multiplier. If a candle’s upper wick is 3x larger than its body, that’s a potential rejection setup. EUR/USD forming this pattern at a resistance level gives traders a concrete, measurable signal rather than subjective “it looks like it got rejected” analysis.

Strengths and Real Limitations

The biggest advantage is objectivity. Two traders looking at the same chart might disagree on whether a candle shows “strong momentum,” but if the Candle Pips Indicator displays a 45-pip body, that’s inarguable data. This removes emotion from analysis and creates consistent entry criteria.

It excels during volatile periods. When the NFP report drops and USD pairs go haywire, watching pip measurements in real-time helps traders distinguish genuine moves from knee-jerk spikes. A 70-pip candle with a 60-pip body suggests sustained pressure. A 70-pip range with a 15-pip body and massive wicks? That’s chaos probably best to sit out.

But here’s the reality check: pip measurements alone don’t predict direction. A 50-pip bearish candle looks impressive until the next candle prints a 60-pip bullish body, completely reversing the move. The indicator quantifies movement but doesn’t explain why it happened or what comes next.

Another limitation surfaces with different account types. Brokers using 5-digit pricing (pipettes) can cause confusion since the indicator must adjust its calculations. A trader switching from a 4-digit broker might see measurements that seem off by a factor of 10 until they recalibrate settings.

The indicator also adds visual noise to charts. Having pip counts on every candle creates clutter, especially on lower timeframes where hundreds of candles fill the screen. That’s why selective display showing only the most recent 50-100 candles is crucial.

How It Stacks Up Against Similar Tools

Compared to ATR (Average True Range), the Candle Pips Indicator provides instant, per-candle feedback rather than an averaged value. ATR tells traders “the pair typically moves 80 pips per day,” while this indicator shows “this specific candle moved 42 pips.” Both have value, but for entry timing, per-candle data wins.

The indicator differs from traditional price labels too. MetaTrader’s built-in OHLC data displays open, high, low, and close prices useful information but requiring mental math to calculate pip movement. The Candle Pips Indicator does that calculation automatically, saving cognitive bandwidth for actual trading decisions.

Against volume indicators, it’s apples and oranges. Volume shows how many contracts traded; pip measurements show price displacement. Ideally, traders combine both large pip movement with high volume confirms real interest, while big candles on low volume might signal thin liquidity or stop hunts.

Final Thoughts on Practical Use

The Candle Pips Indicator MT4 brings measurable structure to candlestick analysis. Traders gain concrete data a 35-pip bullish body with 8-pip wicks versus a 12-pip body with 40-pip wicks tells two completely different stories. That specificity helps build consistent trading systems based on quantified patterns rather than gut feeling. The indicator works best when paired with price action concepts, not as a standalone solution. Risk management still trumps any single tool, and trading forex carries substantial risk regardless of indicator accuracy. No indicator guarantees profits, and drawdowns happen even with perfect pip measurements. That said, for traders who value precision and want clear, objective candle data, this tool delivers exactly what its name promises.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90