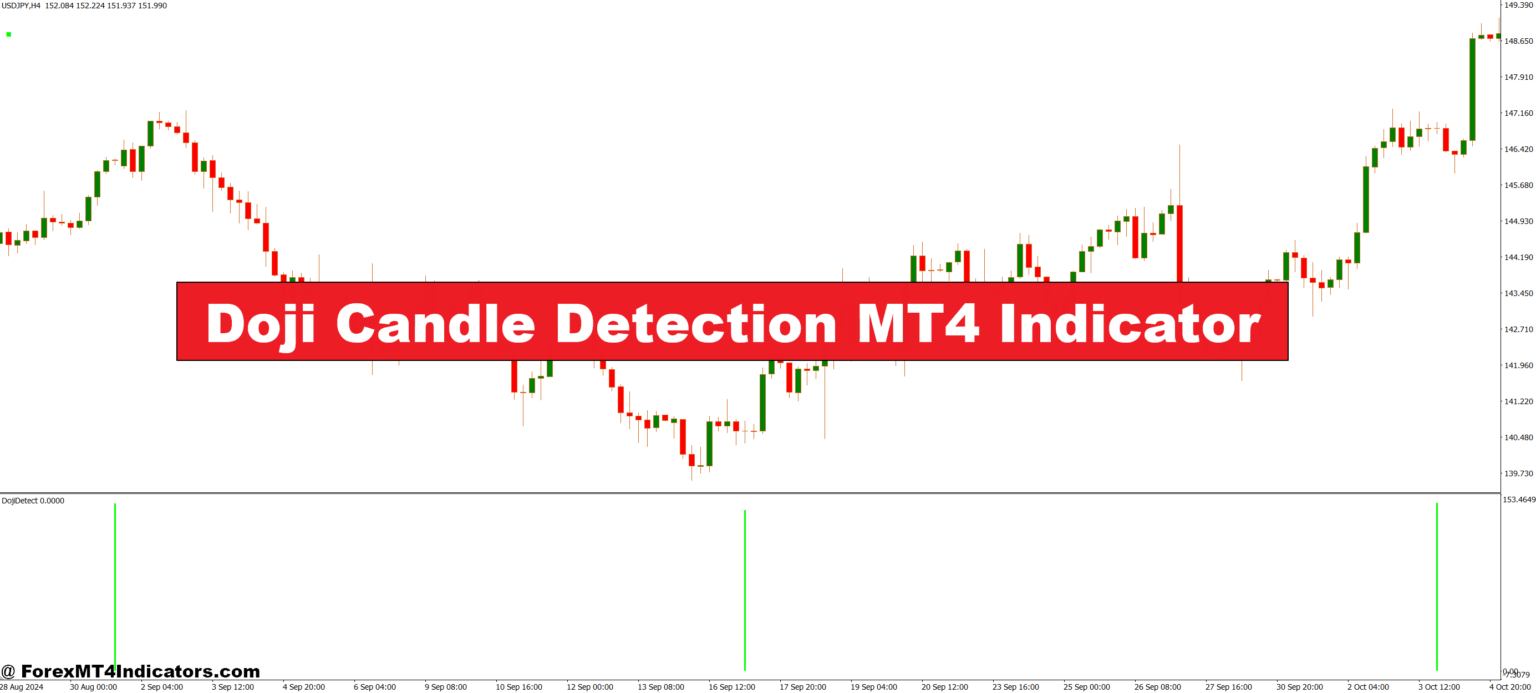

The Doji Candle Detection MT4 Indicator is a simple yet powerful tool that identifies Doji candlestick patterns on any chart. A Doji forms when a candle’s open and close prices are nearly the same, signaling indecision in the market. This indicator scans every candle and instantly marks all Doji formations, so traders don’t have to keep checking each bar manually. It works on all timeframes and currency pairs, making it useful for both short-term and long-term strategies.

Why Doji Candles Matter in Trading

Doji candles are important because they often show a possible reversal point in the market. When they appear after a strong trend, they can hint that buyers or sellers are losing strength. But without a tool to highlight them, it’s easy to miss these subtle clues. The indicator makes it easy to spot these key moments and take action. It’s especially helpful for new traders who are still learning candlestick analysis.

Features That Make Trading Easier

This indicator is beginner-friendly. It adds visual markers directly on the chart wherever a Doji candle appears. Some versions even offer alert options, so traders get notified when a new Doji forms. It doesn’t repaint or lag, so what you see is reliable. The settings can also be customized to adjust sensitivity or focus on specific types of Doji candles, like long-legged or gravestone patterns.

Perfect for Any Strategy

Whether someone trades using trend reversals, breakout entries, or price action methods, this tool fits right in. It doesn’t give buy or sell signals on its own but works best as a confirmation tool. Pair it with support and resistance levels, moving averages, or volume indicators to build a strong trading setup. Many users find it useful for spotting early trend shifts or avoiding false breakouts.

How to Trade with Doji Candle Detection MT4 Indicator

Buy Entry

- Wait for a Doji candle to form after a downtrend (sign of possible reversal).

- Confirm the signal with support zone or price bouncing from a key level.

- Look for bullish confirmation (e.g., a strong bullish candle following the Doji).

- Enter a buy trade on the close of the confirmation candle.

- Place a stop-loss just below the Doji low or recent swing low.

- Set take-profit based on risk-reward ratio (1:2 or 1:3) or next resistance level.

Sell Entry

- Wait for a Doji candle to form after an uptrend (indicates possible reversal).

- Confirm the signal with a resistance zone or price rejecting a key level.

- Look for bearish confirmation (e.g., a strong bearish candle following the Doji).

- Enter a sell trade on the close of the confirmation candle.

- Place a stop-loss just above the Doji high or recent swing high.

- Set take-profit using a risk-reward ratio or the next support level.

Conclusion

The Doji Candle Detection MT4 Indicator is a helpful tool for traders who want to spot important price action signals without the guesswork. By automatically highlighting Doji candles, it saves time and adds clarity to the charts. Whether you’re a beginner or an experienced trader, this indicator can improve decision-making and add value to your strategy.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90