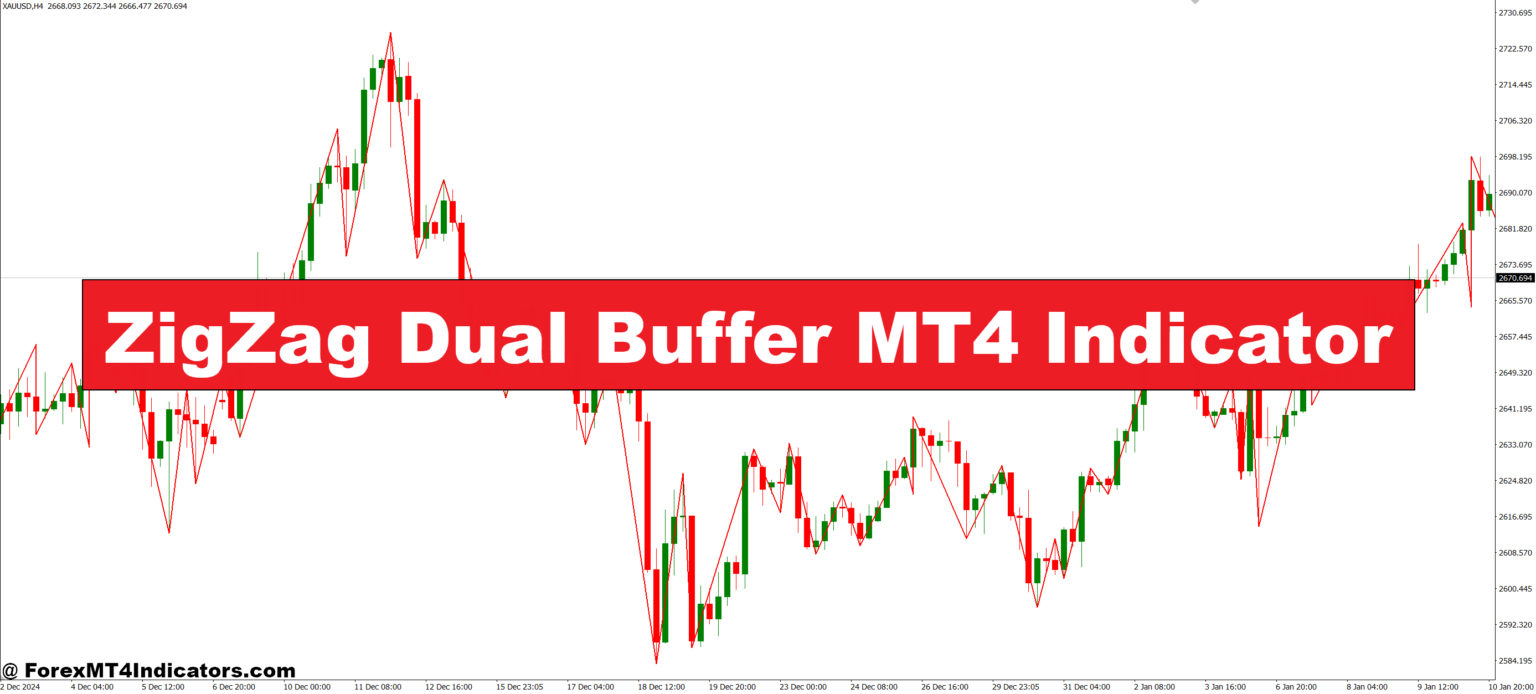

The ZigZag Dual Buffer MT4 Indicator makes it easier for traders to understand market structure by filtering out small price movements and highlighting only the major swings. It connects swing highs and lows with clean lines, offering a clear view of where the price has been and possible reversal points. With its dual-buffer system, it also allows for smoother integration into automated strategies or custom scripts, making it especially helpful for those who rely on algorithmic trading.

Why Dual Buffer Makes a Difference

Unlike the standard ZigZag indicator, the dual buffer version offers better flexibility for developers and traders alike. Each buffer separately represents peaks and troughs, making it easier to backtest or customize trading strategies. For visual traders, this split also helps clarify market direction at a glance. It removes unnecessary clutter while still offering detailed, real-time trend information—something that manual analysis can’t always provide.

Practical Use in Trading Strategies

This indicator works well in trend-following and reversal strategies. Traders can pair it with support/resistance levels or other confirmation tools like RSI or MACD. For example, if the ZigZag line marks a new swing low while RSI shows oversold conditions, it could signal a potential buying opportunity. It’s also great for drawing Fibonacci retracement levels, as the ZigZag helps spot true swing points with greater precision.

How to Trade with ZigZag Dual Buffer MT4 Indicator

Buy Entry

- Wait for the ZigZag to form a clear swing low (bottom point).

- Confirm that the previous leg was downward and the new leg starts to point upward.

- Look for a bullish candlestick pattern (e.g., hammer, engulfing) near the swing low.

- Optional confirmation: RSI crosses above 30 or MACD histogram turns positive.

- Enter the buy trade after the ZigZag confirms the upward turn.

- Place a stop-loss just below the recent swing low.

- Set take profit at the next identified swing high or a predefined risk-reward ratio (e.g., 1:2).

Sell Entry

- Wait for the ZigZag to form a clear swing high (top point).

- Confirm that the previous leg was upward and the new leg starts to slope downward.

- Look for a bearish candlestick pattern (e.g., shooting star, bearish engulfing) near the swing high.

- Optional confirmation: RSI crosses below 70 or MACD histogram turns negative.

- Enter the sell trade after the ZigZag confirms the downward turn.

- Place a stop-loss just above the recent swing high.

- Set take profit at the next identified swing low or based on a fixed reward level.

Conclusion

The ZigZag Dual Buffer MT4 Indicator simplifies the often messy task of analyzing price movement. With its dual-buffer design, it gives traders more accurate and readable trend signals. Whether you’re into manual trading or building your automated strategy, this tool offers a reliable way to stay on top of market changes. It’s a smart addition for any trader looking to make clearer, more confident decisions.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90