The USD remains mostly rangebound against the major currencies as it’s been supported by the last NFP report that caused traders to pare back their bets on a third rate cut by year-end. Unfortunately for the greenback, the data wasn’t enough as wage growth came out on

the softer side which limited further repricing and more sustained gains.

The focus now turns to the US CPI report due on Tuesday. The CPI is unlikely to force the Fed to

cut at the July meeting. September is the earliest we could see it.

Nonetheless, a soft CPI should see the market pricing back in higher

chances of a third cut by year-end and weigh on the US dollar.

On

the other hand, while a hot CPI might not yet make the market to price

out the second cut, it could still dimish the conviction and give the US

dollar a boost, especially given the lopsided bearish positioning on

the greenback.

On the AUD side, the RBA surprised this week by keeping the Cash Rate steady but clarified that they just

wanted to see the next quarterly CPI data. In the bigger picture, as

long as global growth impulse remains positive, the pair should remain

in an uptrend but further hawkish repricing in interest rates

expectations for the Fed could trigger deeper pullbacks in the

short-term.

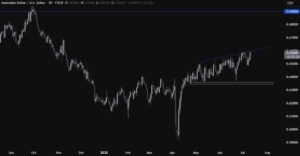

AUDUSD daily

On the daily chart, we can see that the price rallied back into the top trendline that’s been defining the broadening wedge formation. Such compressions are generally followed by strong impulses but we will need a breakout supported by a fundamental catalyst to trigger such a move. For now, the sellers will likely step in around the top trendline with a defined risk above it to position for a drop back into the 0.6350 support zone. The buyers, on the other hand, will look for a break higher to increase the bullish bets into the 0.69 handle next.

AUDUSD 1 hour

On the 1 hour chart, we can see that there’s been already some rejection from the top trendline as the sellers continue to pile in and the buyers might be taking some profits off the table. We have a minor upward trendline defining the bullish momentum on this timeframe. In case we get a pullback into it, the buyer will likely lean on the trendline with a defined risk below it to target a break above the major top trendline. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the 0.6350 support.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.