Global flash PMI readings dominated market headlines early in the day, before the spotlight shifted to the ECB monetary policy decision.

Cautious optimism for progress in EU-US trade talks also contributed to a bit of risk-taking, although U.S. stock indices closed mixed after key earnings releases.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- Australia S&P Global Services PMI Flash for July 2025: 53.8 (51.2 forecast; 51.8 previous)

- Australia S&P Global Manufacturing PMI Flash for July 2025: 51.6 (50.4 forecast; 50.6 previous)

- RBA Governor Bullock: Q2 core inflation likely did not slow as much as initially expected

- RBNZ Chief Economist Conway: Tariffs will mean weaker global economy, weaker demand

- Japan Jibun Bank Services PMI Flash for July 2025: 53.5 (51.3 forecast; 51.7 previous)

- Japan Jibun Bank Manufacturing PMI Flash for July 2025: 48.8 (50.3 forecast; 50.1 previous)

- Germany GfK Consumer Confidence for August 2025: -21.5 (-20.0 forecast; -20.3 previous)

- European Commission President von der Leyen met with Chinese President Xi, mentioned that rebalancing bilateral relations with China is essential

- EU continues to engage in trade talks with U.S. but member states backed potential countertariffs if talks break down before August 1 deadeline

- Euro area HCOB Services PMI Flash for July 2025: 51.2 (50.8 forecast; 50.5 previous)

-

Euro area HCOB Manufacturing PMI Flash for July 2025: 49.8 (49.9 forecast; 49.5 previous)

- France Business Confidence for July 2025: 96.0 (95.0 forecast; 96.0 previous)

- France HCOB Services PMI Flash for July 2025: 49.7 (50.0 forecast; 49.6 previous)

- France HCOB Manufacturing PMI Flash for July 2025: 48.4 (49.1 forecast; 48.1 previous)

- Germany HCOB Services PMI Flash for July 2025: 50.1 (50.5 forecast; 49.7 previous)

- Germany HCOB Manufacturing PMI Flash for July 2025: 49.2 (49.5 forecast; 49.0 previous)

- U.K. S&P Global Manufacturing PMI Flash for July 2025: 48.2 (48.5 forecast; 47.7 previous)

- U.K. S&P Global Services PMI Flash for July 2025: 51.2 (52.9 forecast; 52.8 previous)

- U.K. CBI Industrial Trends Orders for July 2025: -30.0 (-27.0 forecast; -33.0 previous)

- U.K. CBI Business Optimism Index for September 30, 2025: -27.0 (-31.0 forecast; -33.0 previous)

- U.S. Building Permits Final for June 2025: -0.1% m/m to 1.39M (0.2% m/m forecast; -2.0% m/m previous)

-

Euro area ECB Interest Rate Decision for July 24, 2025: 2.15% (2.15% forecast; 2.15% previous)

- Euro area Deposit Facility Rate for July 24, 2025: 2.0% (2.0% forecast; 2.0% previous)

- Euro area Marginal Lending Rate for July 24, 2025: 2.4% (2.4% forecast; 2.4% previous)

-

Canada Retail Sales for May 2025: 4.9% y/y (4.0% y/y forecast; 5.0% y/y previous); -1.1% m/m (-1.1% forecast; 0.3% previous)

- Canada Retail Sales Ex Autos for May 2025: -0.2% m/m (-0.2% m/m forecast; -0.3% m/m previous)

- Canada Manufacturing Sales Prel for June 2025: 0.4% m/m (0.4% m/m forecast; -0.9% m/m previous)

- Canada Retail Sales Prel for June 2025: 1.6% m/m (-0.3% m/m forecast; -1.1% m/m previous)

- U.S. Chicago Fed National Activity Index for June 2025: -0.1 (-0.1 forecast; -0.28 previous)

- U.S. Initial Jobless Claims for July 19, 2025: 217.0k (225.0k forecast; 221.0k previous)

- ECB President Lagarde mentioned during the ECB presser that the economy is “in a good place” and reiterated measured approach to further easing

- U.S. S&P Global Manufacturing PMI Flash for July 2025: 49.5 (52.7 forecast; 52.9 previous)

- U.S. S&P Global Services PMI Flash for July 2025: 55.2 (52.9 forecast; 52.9 previous)

- U.S. New Home Sales for June 2025: 0.6% m/m to 0.63M (10.0% m/m forecast; -13.7% m/m previous)

- U.S. Commerce Secretary Lutnick insisted that the EU and South Korea “really want to make a deal”

- U.S. EIA Natural Gas Stocks Change for July 18, 2025: 23.0Bcf (46.0Bcf previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Risk-taking appeared to be in play early Thursday, as bitcoin and crude oil found support while gold edged lower during the first few hours of the Asian session. Traders appeared to hold on to cautious optimism leading up to the upcoming meeting between leaders of EU and China to discuss trade relations.

Crude oil, which saw a pickup in volatility during the London session, likely drew some support from geopolitical tensions resulting the clash between Thai and Cambodian forces, plus reports that the U.S. State Department approved the sale of defense system to Egypt.

Net positive European flash PMI data, which mostly reflected a slower pace of contraction in both manufacturing and services sectors, gave risk assets another boost as London markets opened. It also helped that European Commission President von der Leyen and Chinese President Xi reinforced trade ties, but a bit of market anxiety kicked in on news that EU member states approved potential countermeasures in case trade talks with the U.S. fall through.

Flash PMI data from the US turned out mixed, further dampening the earlier risk-on mood and leading to a dip in Treasury yields while gold pulled slightly higher. Bitcoin managed to hold its ground around the $119K levels after a previous bounce off the $117K support zone while U.S. equity indices closed mixed in reaction to key earnings data.

FX Market Behavior: U.S. Dollar vs. Majors:

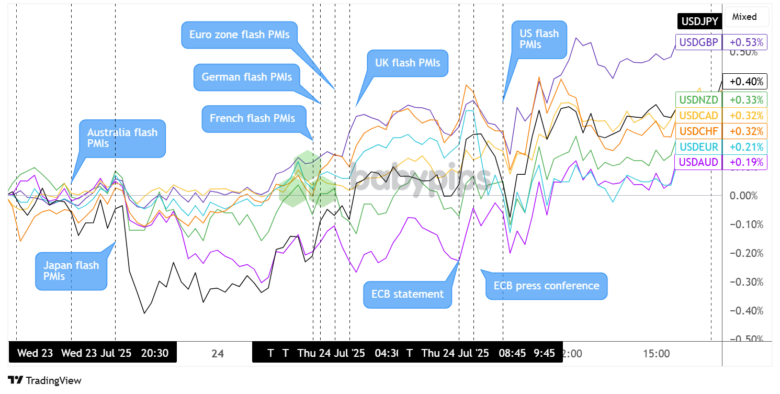

Overlay of USD vs. Majors Chart by TradingView

Global flash PMI readings caught markets’ attention in the Asian and London trading sessions, with Australia reporting improvements in both manufacturing and services sectors while Japan’s manufacturing PMI reflected a surprise return to contraction. The Aussie chalked up additional gains thanks to RBA head Bullock’s less dovish remarks, citing that Q2 inflation likely did not slow as much as initially predicted.

Over in the euro zone, flash PMI figures from Germany and France were generally in line with expectations, indicating a slightly slower pace of contraction in the region. U.K. figures turned out mixed, with the manufacturing PMI coming in somewhat better than expected while the services PMI disappointed.

Meanwhile, the euro found support after the ECB kept rates on hold as expected and Lagarde emphasized that the economy is in a “good place,” reinforcing their measured approach to future easing.

Mixed flash PMI readings from the U.S. economy triggered a brief but mostly bearish reaction from the dollar, except against the Loonie which was on the back foot after Canada printed weaker than expected headline retail sales. By session’s end, the dollar still closed higher across the board as markets remained cautious while global trade talks were ongoing

Upcoming Potential Catalysts on the Economic Calendar

- Japan Leading Indicators Index at 5:00 am GMT

- U.K. Retail Sales at 6:00 am GMT

- France Consumer Confidence at 6:45 am GMT

- Germany Ifo Business Climate at 8:00 am GMT

- Euro area Loans to Households at 8:00 am GMT

- Euro area Loans to Companies at 8:00 am GMT

- Euro area M3 Money Supply at 8:00 am GMT

- U.S. Durable Goods Orders at 12:30 pm GMT

- Canada Budget Balance at 3:00 pm GMT

Only a handful of mid-tier releases are lined up on today’s docket, namely the U.K. retail sales report and German Ifo business climate index during the London session then the U.S. durable goods orders report that could shake things up during New York market hours.

Unless these releases show major surprises, overall market sentiment driven by tariffs-related headlines and trade negotiations progress could dictate how major currencies behave, so make sure you keep close tabs on any updates.

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!