The U.S. private sector unexpectedly lost 33,000 jobs in June, a big miss compared to the forecast for a 95,000 gain. That’s the first drop since March 2023, and to make things worse, May’s figure was revised down to 29,000 from 37,000.

Most of the weakness came from services, with professional and business services down 56,000 and education and health services shedding 52,000. Still, there were a few bright spots: manufacturing, construction, and leisure and hospitality all added jobs.

Link to ADP Non-farm Employment Report for June 2025

Key points from the release:

- Service sectors led the decline: professional/business services (-56,000) and education/health services (-52,000)

- Manufacturing, construction, and leisure/hospitality posted gains

- Annual wage growth held steady at 4.4% despite job losses

- ADP cited “hesitancy to hire” amid trade policy uncertainty

ADP’s Chief Economist, Nela Richardson, noted that “though layoffs continue to be rare, a hesitancy to hire and a reluctance to replace departing workers led to job losses last month.”

Market Reactions

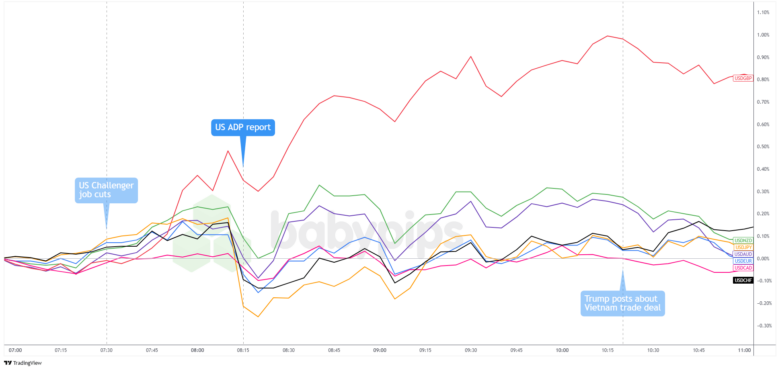

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar had been cruising higher earlier in the session, likely from some profit-taking ahead of Thursday’s jobs report. But that momentum hit a wall when the ADP numbers came in way below expectations.

The dip didn’t last long, though. USD/JPY and USD/CHF picked up right where they left off after a quick breather, and EUR/USD crept up toward the 1.1700 mark.

The muted dollar reaction may have been caused by two things. One, ADP has a spotty track record predicting the official NFPs, so traders aren’t exactly scrambling to reposition just yet. And two, even with the ugly headline number, wage growth held steady at 4.4%, which signals the labor market isn’t falling apart just yet.

With the Fed still on pause and watching how tariffs ripple through inflation, rate cut expectations later in 2025 are keeping a lid on any serious dollar strength for now.