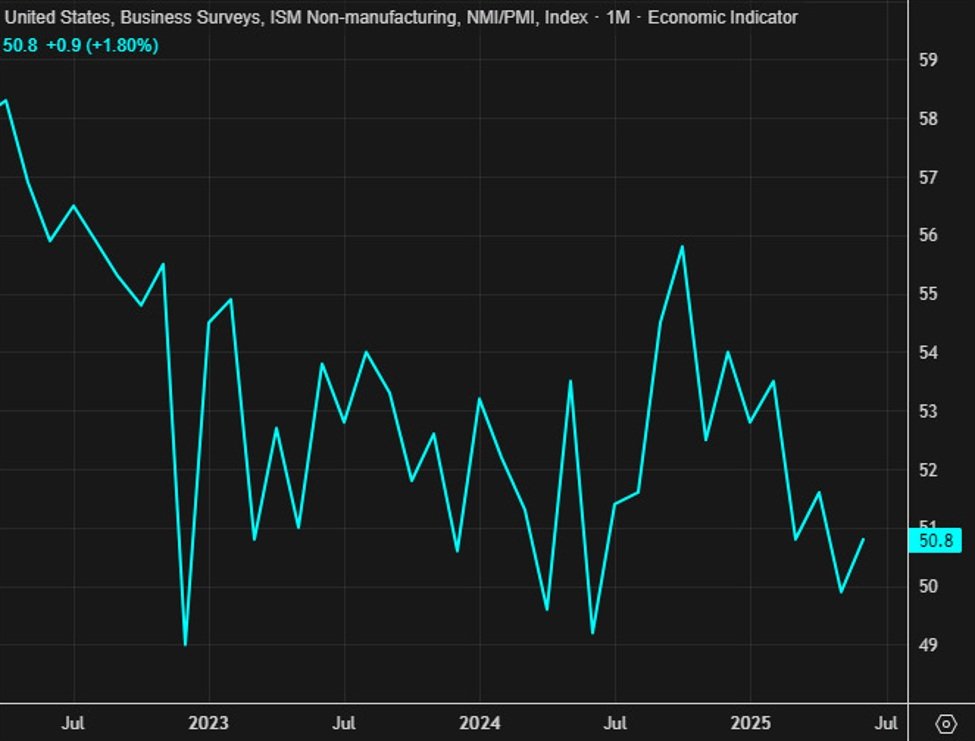

- Prior was 49.9

- Prices paid: 67.5 vs. 68.7 prior

- New orders: 51.3 vs. 46.7 prior –

- Employment: 47.2 vs 50.7 prior – lowest since March

- Business activity: 54.2 vs. 50.0 prior

- Supplier deliveries: 50.3 vs. 52.5 prior

- Inventories: 52.7 vs. 49.7 prior

- Backlog of orders: 42.4 vs. 43.4 prior

- New export orders: 51.1 vs. 48.5 prior

- Imports: 51.7 vs. 48.2 prior

- Inventory sentiment: 57.1 vs. 62.9 prior

The employment report adds to the puzzle around the real jobs situation in the US as this matches the softness in the ADP report but goes against the stronger non-farm payrolls data. The ISM employment number has only been in positive territory once since February.

Comments in the report:

- “Restaurant sales and traffic remain flat to prior year. Staffing is

adequate for our current needs, and no supply chain concerns this

month.” [Accommodation & Food Services] - “Increased cost from tariffs and the potential for tariffs is

impacting cost increases. Higher cost of high-dollar items like

150-horsepower farm tractors are forcing farmers to delay purchasing or

purchase used equipment. Tension in the Middle East is creating great

concern and uncertainty.” [Agriculture, Forestry, Fishing & Hunting] - “Sales remain stubbornly slow due to affordability issues with

higher mortgage rates and high property values. Residential construction

has embarked on cost-cutting measures through value engineering,

supplier margin reductions and layoffs.” [Construction] - “Prices have gone up from tariff recovery fees — separate line items

— but the supply chain, deliveries and inventories have remained mostly

stable after the initial disruption. Costs continue to increase across

the board, so our goal is to mitigate that.” [Health Care & Social

Assistance] - “General uncertainty around the economy continues to drive increases

in prices. Also, lots of SaaS (software-as-a-service) vendors are using

the AI (artificial intelligence) boom to restructure pricing and

products, resulting in massive increases.” [Information] - “After several slow months, business is starting to increase. New requests are going out to suppliers.” [Other Services]

- “Confidence in a predictable economic environment has eroded to a

point where capital investments are being severely curtailed.”

[Professional, Scientific & Technical Services] - “Business growth is slow. Global economic conditions impacted by

U.S. tariffs are creating significant uncertainty, which is holding

businesses back from making short- to medium-term business decisions.”

[Real Estate, Rental & Leasing] - “Lead times are extending in the past month or two. Seeing

high-single- or low-double-digit percent increases in pricing on metals

related to commodity hardware and products.” [Utilities] - “Business seems to be picking up. Many of the macroeconomic factors

that were concerning look to be playing out in our favor. High interest

rates are still a problem. Supplies are ample for current business

levels.” [Wholesale Trade]

This article was written by Adam Button at www.forexlive.com.

Source link